Are you looking for a reliable vehicle warranty to protect your investment? An Assurance Car Warranty can provide you with peace of mind, covering unexpected repair costs and ensuring your vehicle remains in good condition.

With a car warranty, you can drive with confidence, knowing you’re protected against costly repairs. Assurance Car Warranty offers comprehensive coverage, giving you and your family a worry-free driving experience.

Key Takeaways

- Reliable coverage for your vehicle with Assurance Car Warranty

- Protection against unexpected and costly repairs

- Comprehensive coverage for a worry-free driving experience

- Peace of mind for you and your family

- Investment protection for your vehicle

What Is an Assurance Car Warranty?

In the automotive world, an Assurance Car Warranty represents a safeguard against the rising costs of vehicle maintenance and repairs. This type of warranty is designed to provide financial protection to vehicle owners beyond the standard manufacturer’s warranty period.

Definition and Basic Concepts

An Assurance Car Warranty, also known as an extended car warranty or auto warranty, is a service contract that covers the cost of repairs and replacements for vehicle components. The warranty definition encompasses a broad range of coverage options, from basic powertrain warranties to comprehensive bumper-to-bumper plans.

How It Differs from Factory Warranties

Unlike factory warranties that come standard with new vehicles, an Assurance Car Warranty is typically purchased separately, either from the dealership or a third-party provider. This distinction is crucial, as it allows vehicle owners to extend their protection beyond the original warranty period.

The Evolution of Vehicle Protection Plans

Vehicle protection plans have evolved significantly over the years, adapting to advancements in automotive technology and changing consumer needs. Today, Assurance Car Warranties offer a range of benefits, including financial protection against costly repairs and peace of mind for drivers.

| Warranty Type | Coverage | Duration |

|---|---|---|

| Factory Warranty | Basic Vehicle Components | Typically 3 years or 36,000 miles |

| Assurance Car Warranty | Extended Coverage Options | Varies (e.g., 5 years or 100,000 miles) |

Why Vehicle Owners Need Extended Protection

With rising repair costs, financial security through a car protection plan is becoming essential for vehicle owners. Modern vehicles are equipped with complex systems that can be expensive to repair or replace.

Rising Repair Costs in Modern Vehicles

The increasing complexity of vehicles has led to higher repair costs. Advanced technologies, such as electric vehicles and sophisticated driver assistance systems, require specialized labor and parts, increasing the financial burden on vehicle owners.

Financial Security Against Unexpected Breakdowns

A vehicle protection plan offers financial security by covering unexpected breakdowns and repairs. This not only saves money but also reduces the stress associated with dealing with costly repairs.

Peace of Mind for Daily Driving

Having a car protection plan in place provides peace of mind for daily driving. Vehicle owners can drive with confidence, knowing they are protected against unexpected breakdowns and costly repairs. Key benefits include:

- Reduced financial stress

- Protection against costly repairs

- Enhanced driving confidence

In conclusion, a car protection plan is a vital investment for vehicle owners, providing financial security and peace of mind in the face of rising repair costs.

Types of Assurance Car Warranty Plans

The Assurance Car Warranty comes in several types, each designed to offer unique benefits to vehicle owners. Understanding these different plans is crucial in selecting the one that best fits your needs.

Comprehensive Bumper-to-Bumper Coverage

This type of warranty coverage is extensive, covering most vehicle components from the bumper to the bumper. It’s ideal for those who want comprehensive protection against various potential issues.

What’s Included

- Majority of vehicle’s components

- Electrical and electronic systems

- Mechanical components

Ideal Candidates

New car owners or those who want comprehensive protection will find this plan ideal. It’s also suitable for drivers who use their vehicles under normal to moderate conditions.

Powertrain Warranty Options

The powertrain warranty focuses on the vehicle’s core components, such as the engine, transmission, and drivetrain. It’s designed for those who want to protect their vehicle’s essential systems.

Component-Specific Protection Plans

For owners who want to protect specific parts of their vehicle, component-specific plans are available. These plans allow for customization based on the owner’s concerns and the vehicle’s condition.

By understanding the different types of Assurance Car Warranty plans, vehicle owners can make informed decisions about their vehicle’s protection. Whether you opt for bumper-to-bumper coverage, a powertrain warranty, or a component-specific plan, having the right warranty coverage provides peace of mind and financial security against unexpected repair costs.

Coverage Details: What’s Protected Under Assurance Car Warranty

To get the most out of your Assurance Car Warranty, it’s vital to understand the details of the coverage. The Assurance Car Warranty is designed to provide comprehensive protection for your vehicle, covering a wide range of components and systems.

Engine and Transmission Components

The Assurance Car Warranty includes coverage for critical engine and transmission components. This encompasses major parts such as the engine block, cylinder head, and transmission gears, ensuring that you’re protected against costly repairs.

Electrical and Electronic Systems

Modern vehicles rely heavily on electrical and electronic systems. The Assurance Car Warranty covers these complex systems, including components like the starter, alternator, and wiring, as well as advanced electronic modules.

Steering, Suspension, and Braking Systems

Your vehicle’s steering, suspension, and braking systems are crucial for safety and performance. The Assurance Car Warranty provides coverage for these vital systems, including parts like steering racks, suspension struts, and brake pads.

Heating and Air Conditioning Coverage

The Assurance Car Warranty also includes coverage for your vehicle’s heating and air conditioning system, ensuring that you’re protected against failures in components like the compressor, condenser, and evaporator.

| System | Covered Components |

|---|---|

| Engine | Engine block, cylinder head, pistons |

| Transmission | Transmission gears, clutch, torque converter |

| Electrical & Electronic | Starter, alternator, wiring, electronic modules |

| Steering, Suspension, Braking | Steering rack, suspension struts, brake pads |

| Heating & Air Conditioning | Compressor, condenser, evaporator |

Understanding Warranty Exclusions and Limitations

When investing in an Assurance Car Warranty, it’s crucial to understand what’s not covered. Knowing the exclusions and limitations can save you from unexpected expenses and help you make the most out of your warranty.

Common Non-Covered Components

Typically, an Assurance Car Warranty does not cover components that are subject to normal wear and tear, such as brake pads and clutch linings. Understanding these exclusions is key to avoiding surprises when filing a claim.

Other non-covered components may include maintenance-related items like oil changes, tire rotations, and replacements due to wear. It’s essential to review your warranty contract to understand these specifics.

Maintenance-Related Exclusions

Maintenance-related exclusions are a critical aspect of your warranty. Failing to maintain your vehicle according to the manufacturer’s schedule can void certain aspects of your coverage.

Regular maintenance is not only crucial for the longevity of your vehicle but also for keeping your warranty valid. This includes oil changes, fluid checks, and other scheduled services.

Modification and Misuse Clauses

Modifying your vehicle or using it in ways not intended by the manufacturer can lead to exclusions under your Assurance Car Warranty. Understanding these clauses is vital to ensure you don’t inadvertently void your coverage.

For instance, using your vehicle for racing or significantly altering its engine or transmission can be considered misuse, potentially excluding these components from warranty coverage.

Reading the Fine Print Effectively

To truly understand what is excluded from your Assurance Car Warranty, it’s essential to read the fine print. This involves carefully reviewing the warranty contract and asking questions if you’re unsure.

Paying close attention to the terms and conditions can help you understand what is covered and what is not, ensuring you’re not caught off guard when you need to file a claim.

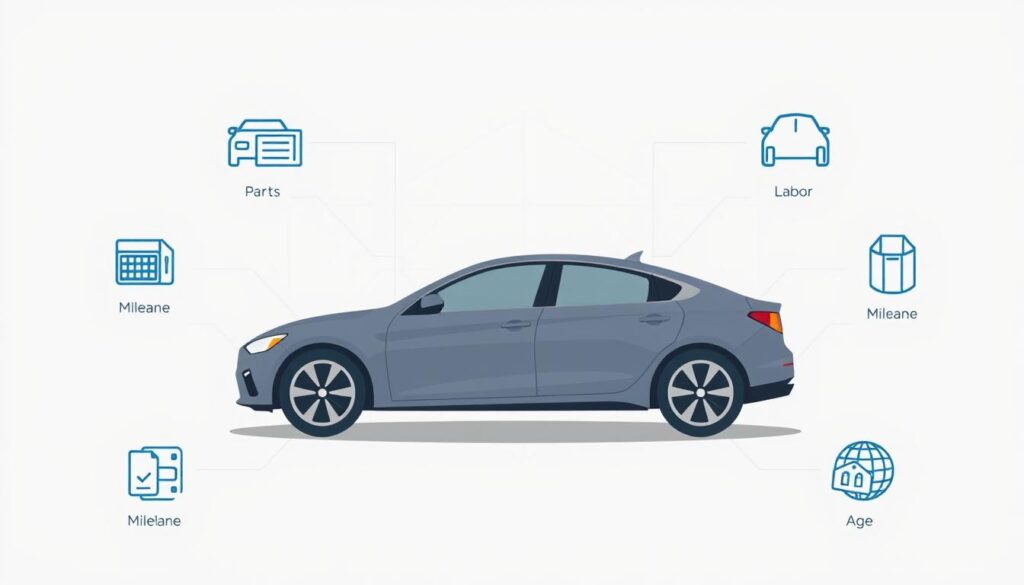

Cost Factors and Pricing Structure

When considering an Assurance Car Warranty, it’s essential to understand the factors that impact its pricing. The cost of such a warranty isn’t determined by a single element; rather, it’s the culmination of several key factors.

Vehicle Age, Make, and Model Considerations

The age, make, and model of your vehicle significantly influence the warranty cost. Newer vehicles or those from premium brands often come with higher warranty costs due to potentially higher repair costs.

Mileage Impact on Premium Rates

Your vehicle’s mileage also plays a crucial role in determining premium rates. Higher mileage vehicles are typically more expensive to insure under a warranty due to the increased likelihood of mechanical failures.

Coverage Level and Term Length Options

The level of coverage you choose and the term length of your warranty directly affect its cost. Comprehensive coverage over a longer term will naturally be more expensive.

Deductible Choices and Their Effect on Cost

Your deductible choice can also impact your warranty cost. A lower deductible means higher premiums, while a higher deductible can reduce your premium costs but may result in higher out-of-pocket expenses when filing a claim.

Understanding these factors can help you make an informed decision when selecting an Assurance Car Warranty, ensuring you get the right coverage at a price that fits your budget.

- Assess your vehicle’s specific needs based on its age, make, and model.

- Consider your vehicle’s mileage and its impact on premium rates.

- Choose a coverage level and term length that aligns with your financial situation and vehicle condition.

- Select a deductible that balances your premium costs with your ability to pay out-of-pocket expenses.

How to Purchase the Right Assurance Car Warranty

To ensure you’re getting the right Assurance Car Warranty, it’s essential to explore different purchase options. Buying a warranty can be a complex process, but understanding your choices can make a significant difference.

Dealership Purchase Options

One common way to purchase an Assurance Car Warranty is through a dealership. Dealerships often offer warranty products as part of their sales package. It’s crucial to carefully review the terms and conditions of these warranties to ensure they meet your needs. Dealership warranties might be convenient, but they may not always be the most comprehensive or cost-effective option.

Third-Party Provider Considerations

Third-party warranty providers offer an alternative to dealership warranties. These companies specialize in vehicle protection plans and often provide more flexible coverage options. When considering a third-party provider, research their reputation and customer reviews to ensure you’re dealing with a reputable company.

Online Research and Buying Process

The internet is a valuable resource for researching and buying Assurance Car Warranties. Online platforms allow you to compare different plans and providers easily. Take the time to read reviews and understand the fine print before making a decision.

Negotiation Strategies for Better Terms

Whether you’re buying from a dealership or a third-party provider, there may be opportunities to negotiate the terms of your warranty. Don’t hesitate to ask about discounts or additional benefits. Understanding the negotiation process can help you secure a better deal.

The Claims Process Demystified

Understanding the claims process is crucial for Assurance Car Warranty holders to ensure a smooth experience when filing a claim. This process, while potentially complex, can be navigated effectively with the right information.

Step-by-Step Claim Filing Procedure

Filing a claim under your Assurance Car Warranty involves several key steps. First, contact your warranty provider as soon as possible after discovering an issue with your vehicle. They will guide you through the initial steps and provide the necessary forms.

Next, gather all required documentation, including your warranty contract, vehicle registration, and any relevant repair estimates. Submitting a complete and accurate claim is crucial for a smooth process.

Required Documentation and Evidence

To file a successful claim, you’ll need to provide comprehensive documentation. This typically includes:

- Your Assurance Car Warranty contract details

- Vehicle maintenance records

- Repair estimates or invoices

- Photos or videos of the issue (if required)

Working with Repair Facilities

Assurance Car Warranty often works with a network of repair facilities. You can choose a facility from their recommended list or, in some cases, use your preferred mechanic. Ensure that the repair facility is aware of your warranty coverage to facilitate direct billing where possible.

Handling Claim Disputes Effectively

If your claim is denied or disputed, it’s essential to understand the reason behind the decision. Review your warranty contract carefully and contact your provider to discuss the issue. Many disputes can be resolved through clear communication and additional information.

By following these steps and understanding the claims process, you can ensure a more straightforward experience when filing a claim under your Assurance Car Warranty.

Evaluating Assurance Car Warranty Providers

To make an informed decision, it’s vital to assess Assurance Car Warranty providers based on several critical factors. This evaluation process ensures that you select a reliable warranty that meets your vehicle’s needs.

Reputation and Industry Standing

A provider’s reputation is a crucial indicator of their reliability and service quality. Look for companies with a strong industry standing, as this often reflects their commitment to customer satisfaction and claims handling.

Researching a provider’s history and checking for any industry certifications or affiliations can provide valuable insights into their credibility.

Customer Review Analysis

Customer reviews offer firsthand experiences with a warranty provider. Analyze reviews across multiple platforms to identify common themes, both positive and negative.

Pay particular attention to how a provider responds to customer complaints, as this can indicate their level of customer service.

Financial Stability Indicators

A warranty provider’s financial stability is essential for ensuring that they can fulfill their obligations when you need to make a claim.

Look for indicators such as financial ratings from reputable agencies, which can provide insight into a company’s financial health.

Customer Service Quality Assessment

Effective customer service is vital for a smooth warranty experience. Evaluate the provider’s communication channels, response times, and the knowledge of their support staff.

A provider with high-quality customer service can significantly reduce stress and make the warranty process more manageable.

Comparing Warranty Options for Your Vehicle

The right warranty can provide peace of mind for vehicle owners, but with so many options, how do you choose? Comparing different warranty options is essential to find the best fit for your vehicle.

Manufacturer Extended Warranties vs. Third-Party Plans

When deciding between manufacturer extended warranties and third-party plans, consider the coverage details and cost implications. Manufacturer extended warranties offer continuity with the dealership, potentially simplifying the claims process. On the other hand, third-party plans can sometimes offer more flexible coverage options and competitive pricing.

It’s crucial to evaluate the reputation of the warranty provider, whether it’s the manufacturer or a third-party company. Researching customer reviews and ratings can provide insights into the reliability and service quality of the warranty provider.

Mechanical Breakdown Insurance Alternatives

Mechanical breakdown insurance (MBI) is another option to consider. It typically covers repairs after the manufacturer’s warranty expires, offering protection against costly breakdowns. When evaluating MBI, look at the coverage limits, deductibles, and any exclusions.

Self-Insuring Through Dedicated Savings

Some vehicle owners prefer self-insuring by setting aside money in a dedicated savings account for potential repair costs. This approach requires discipline and a clear understanding of your vehicle’s condition and potential repair needs.

Combination Approaches for Optimal Protection

For optimal protection, consider combining different warranty options. For instance, you might pair a manufacturer’s warranty with a third-party plan for additional coverage or supplement with mechanical breakdown insurance. This layered approach can provide comprehensive protection tailored to your vehicle’s specific needs.

Ultimately, the best warranty comparison will depend on your vehicle’s make, model, and age, as well as your financial situation and risk tolerance. By carefully evaluating these factors and exploring different warranty options, you can make an informed decision that provides the best protection for your vehicle.

Maximizing Your Warranty Benefits

Maximizing your warranty benefits requires a combination of proper vehicle maintenance, thorough documentation, and a clear understanding of your policy terms. By focusing on these key areas, you can ensure that you’re getting the most out of your Assurance Car Warranty.

Maintenance Requirements for Valid Coverage

Regular maintenance is crucial to keeping your warranty valid. This includes routine checks and services such as oil changes, tire rotations, and brake pad replacements. Neglecting these services can void your warranty, leaving you with costly repairs.

Documentation Best Practices

Keeping accurate records of maintenance and repairs is essential. Use a dedicated folder or digital storage to organize receipts, invoices, and service records. This will help ensure you have the necessary documentation in case you need to file a claim.

Understanding Transfer and Cancellation Policies

If you sell your vehicle, understanding your warranty’s transfer policy can be a significant selling point. Some warranties are transferable, which can increase your vehicle’s resale value. Conversely, knowing the cancellation policies can help you make informed decisions if your circumstances change.

Leveraging Additional Perks and Benefits

Many Assurance Car Warranties come with additional benefits, such as roadside assistance or rental car coverage. Familiarize yourself with these perks to maximize your warranty’s value.

| Benefit | Description | Value |

|---|---|---|

| Roadside Assistance | 24/7 help for towing, fuel delivery, and more | $50-$100 per service |

| Rental Car Coverage | Covers rental car costs while your vehicle is being repaired | Up to $50 per day |

| Trip Interruption | Reimbursement for meals and lodging if your trip is interrupted due to a breakdown | Up to $500 per incident |

Conclusion: Making an Informed Warranty Decision

Choosing the right Assurance Car Warranty requires careful consideration of various factors, including coverage options, pricing, and provider reputation. By understanding the different types of warranty plans available, vehicle owners can make an informed decision that suits their needs and budget.

A well-informed warranty decision can provide financial security and peace of mind against unexpected breakdowns and repair costs. It’s essential to evaluate the coverage details, exclusions, and limitations before making a purchase.

When selecting a car warranty, consider factors such as vehicle age, mileage, and condition. Researching and comparing different warranty providers can help you find the best option for your vehicle. By doing so, you can ensure that you’re making a warranty decision that provides optimal protection for your car.

Making an informed decision about your car warranty can save you from financial stress and ensure that your vehicle remains protected. Take the time to review your options and choose a warranty that meets your needs.